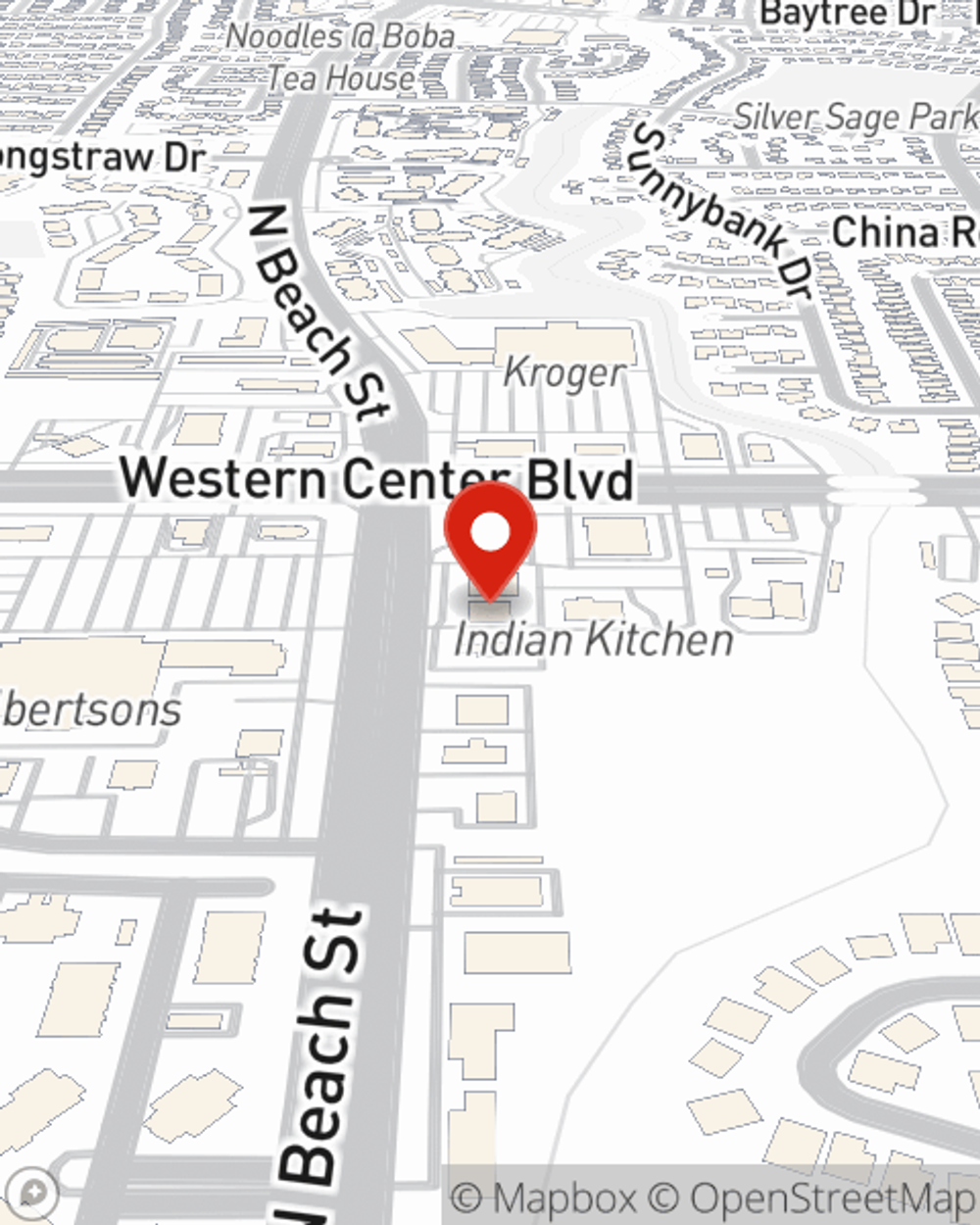

Business Insurance in and around Haltom City

Looking for small business insurance coverage?

This small business insurance is not risky

Business Insurance At A Great Value!

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with extra liability coverage, errors and omissions liability and a surety or fidelity bond.

Looking for small business insurance coverage?

This small business insurance is not risky

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Eddie Bermea for a policy that safeguards your business. Your coverage can include everything from business continuity plans or errors and omissions liability to key employee insurance or professional liability insurance.

Call Eddie Bermea today, and let's get down to business.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Eddie Bermea

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.